Account Receivable

Agility - Optimization - Personnalization

Performance in Management & Technology

Modules

-

Financial Modules

- Manager's Dashboard

- General Ledger

- Accounts receivable

- Accounts payable

-

Operation Management

- Inventory

- Purchasing

- Production Management

- Costing

- Project Management

- Maintenance

-

Customer Service

- Invoicing

- CRM

- E-Commerce

- EDI

-

H.R. Modules

- Payroll

- Human Resources

-

Basic Modules

- Access Control

- API Interface

Finance Pro+ Accounts Receivable helps you free up funds frozen in receivables.

Finance Pro+ Accounts Receivable helps you free up funds frozen in receivables.

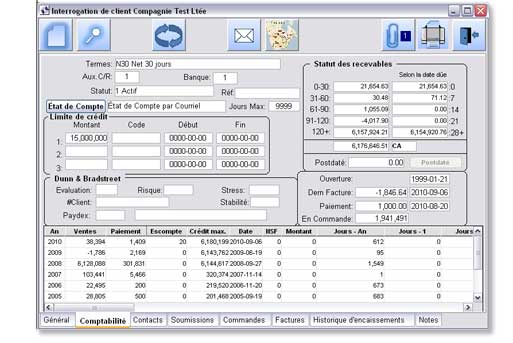

One of the keys to success in your business is your ability to ensure a constant influx of funds, without undue delays. The Finance Pro+ Accounts Receivable module gives you all the tools necessary to manage customer credit and keeps all information on file thus speeding up collection. You can quickly zero in on problem clients for prompt corrective action.

As well as basic information, the client record also includes statistics on average payment time, any progress made and on the maximum credit level reached. A complete transaction history allows you to follow the account operations in detail. The query will even display the documents related to the transaction, whether it be an invoice, discounts or products sold along with any notes attached to the file.

Account follow-up can be programmed and users can be notified automatically concerning their roles.

Finance Pro+ lets you enter an unlimited number of notes on each client and link them, if you wish, to a follow-up date. The user will be automatically notified when the follow-up call takes place.

The terms of payment may be different for current invoices and for overdue invoices. For example, you can call up current invoices every 30 days and call up overdue invoices every 7 days.

The Accounts Receivable module can handle an unlimited variety of foreign currencies and allows you to use several currencies during the same transaction. Profit and loss on currency exchange is automatically entered! Furthermore, each module supports an unlimited number of special journals and different bank accounts.

Features

Clients

Contacts

Shipping addresses

Sales representatives

Market segments

Regions

Transactions

Manual invoicing

Adjustments

Cash receipts

Post-dated cheques

Follow-up by client

Special journals

Queries

By client

Payment history by year/month

By invoice

Drill-down by level of detail

Reports

Age of accounts - summary

Age of accounts - detail

Aging by invoice or due date

Statements